Stop the Suits Tour: International Investment Agreements Threaten People and the Environment from El Salvador to Canada

May 5, 2015

(Montreal/Ottawa/Toronto) In anticipation of an imminent ruling from a little-known arbitration tribunal at the World Bank that could force El Salvador to pay Canadian-Australian mining firm OceanaGold US$301 million, a Salvadoran delegation will visit Canada next week to discuss how investor-state arbitration threatens democratic decision-making, public health and the environment here and beyond our borders.

OceanaGold is suing El Salvador for an amount equivalent to 5% of its gross domestic product for not having granted it a permit to put a gold mine into operation, despite its project not having met regulatory requirements. Originally, Pacific Rim Mining launched the suit in 2009 after the first of three successive Salvadoran Presidents committed to an effective moratorium on new mining projects given concerns over potential impacts on already taxed water supplies. OceanaGold purchased Pacific Rim Mining in 2013, narrowly saving it from bankruptcy, and has stubbornly continued with the case. The International Center for the Settlement of Investment Disputes (ICSID) at the World Bank could release its decision on the suit any day.

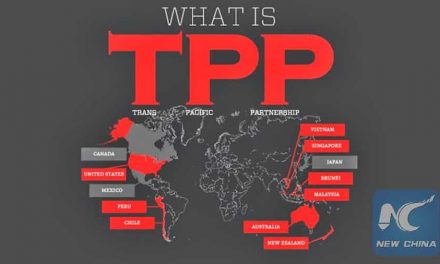

From May 11 to 15, Yanira Cortez, Deputy Attorney for the Environment for El Salvador’s Human Rights Prosecutor’s Office and Marcos Gálvez, President of the Association for the Development of El Salvador (CRIPDES, a founding member of the National Roundtable against Metal Mining) will travel to Montreal, Ottawa-Gatineau and Toronto. They will speak publicly and meet with Members of Parliament to request support for the Salvadoran people’s struggle and warn of dangers that Canadians face through investor provisions in existing and proposed free trade agreements, such as the North American Free Trade Agreement (NAFTA), the Canada and European Union Comprehensive Economic and Trade Agreement (CETA), and the Trans Pacific Partnership (TPP).

Canadian taxpayers have already paid out tens of millions to foreign corporations and could be on the hook for tens of millions more in suits brought under NAFTA for decisions made in the public interest. In a case eerily similar to the one El Salvador faces, Lone Pine Resources is suing Canada for $250 million in response to Quebec’s decision to put a moratorium on shale gas mining, better known as fracking. This measure, broadly supported in Quebec, is premised on concern for people’s health and the environment. Calgary-based Lone Pine Resources is using a US affiliate to bring the suit and has insisted that it will continue to pursue the case unless Quebec lifts its moratorium.